Dam Hong Industrial Cluster, Yen Bai Province

The Dam Hong Industrial Cluster is a key industrial zone in Yen Bai Province, located in Van Phu Commune and part of Yen Ninh Ward, Yen Bai City. It plays an important role in the development of industry and socio-economic growth. With a strategic location, modern infrastructure, and strong resources, the cluster attracts many investment projects. This has contributed to local economic development, job creation, and improved quality of life for residents.

Key Points to Note

- Dam Hong Industrial Cluster is a major industrial hub in Yen Bai Province

- Strategic location and modern infrastructure attract many investment projects

- Contributes to economic growth, creates jobs, and enhances residents’ living standards

- Drives industrialization and socio-economic development in the region

- High potential for development with abundant resources

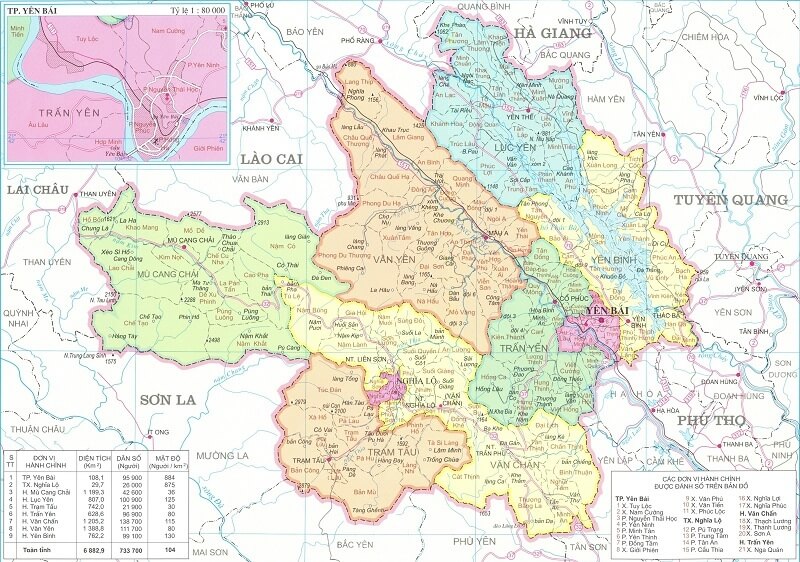

Geographic Location of the Dam Hong Industrial Cluster

The Dam Hong Industrial Cluster is situated in Van Phu Commune and part of Yen Ninh Ward, Yen Bai City. Its location offers favorable conditions, being close to district centers and major transportation routes, which facilitate the transport of raw materials and goods.

Geographic Features of the Area

The terrain of the Dam Hong I.C is relatively flat with a mild climate and abundant water resources. These features provide a competitive advantage for the cluster.

Transportation Connections

The Dam Hong I.C has a well-connected transportation network. It is accessible via national highways, provincial roads, and internal roads, making it easy for investors and businesses to transport materials and products.

| Feature | Description |

| Geographic Location | Located in Luc Yen District, Yen Bai Province, near the district center |

| Natural Conditions | Flat terrain, mild climate, abundant water |

| Transportation Connections | Convenient network of national highways, provincial roads, and internal roads |

The cluster’s favorable location and natural conditions are key competitive advantages, attracting investors and businesses.

vinascreal.com

History of Formation and Development

The Dam Hong Industrial Cluster was established in 2005, starting as a small area with a few factories focused on agricultural processing.

In recent years, the cluster has experienced rapid growth, attracting projects from both domestic and international investors.

This development has driven the industrialization and modernization of Yen Bai Province. Today, the Dam Hong I.C is a prominent economic hub, featuring key industries such as agricultural processing and building materials production.

The cluster has evolved from a small industrial area to a dynamic industrial center, enhancing the region’s economic competitiveness.

Key Industries

The Dam Hong I.C plays a vital role in promoting local economic growth. It focuses on two main industries: agricultural processing and building materials production.

Agricultural Processing Industry

Agricultural processing is the cluster’s core industry, utilizing locally sourced raw materials. Products are supplied to the provincial market and exported to other regions, contributing to the growth of the local economy.

Building Materials Production Industry

Building materials production is another key sector. Factories in the cluster produce a variety of materials, including cement, bricks, tiles, doors, and wooden flooring. These products are sold within the province and distributed to external markets.

Overview of the Dam Hong Industrial Cluster

The Dam Hong Industrial Cluster was established in 2010 and covers more than 200 hectares, hosting numerous factories and enterprises.

Located in the heart of Yen Bai Province, the cluster aims to attract businesses and promote socio-economic development. The key industries include agricultural processing and building materials production.

| Criteria | Dam Hong Industrial Cluster |

| Total Area | 71 hectares |

| Establishment Year | 2009 |

| Main Industries | Agricultural processing, building materials production |

| Role | Promotes socio-economic development in Yen Bai Province |

With its strategic location and attractive investment policies, the Dam Hong I.C continues to grow rapidly.

Potential and Advantages of the Industrial Cluster

The Dam Hong I.C benefits from favorable climate and soil conditions, ideal for agriculture. It produces various agricultural products such as rice, corn, sweet potatoes, peanuts, fruits, and vegetables, which provide ample raw materials for processing industries.

Abundant Raw Materials

The geographical and climatic conditions of the cluster support the production of a wide range of agricultural products, creating opportunities for businesses involved in agricultural processing.

Skilled Workforce

The cluster has a large, skilled labor force, which serves as a competitive advantage for enterprises seeking talent.

With abundant raw materials and a skilled workforce, the Dam Hong I.C attracts both domestic and foreign investors.

Role of the Industrial Cluster in Local Economic Development

The Dam Hong Industrial Cluster serves as a foundation for socio-economic development in Yen Bai Province. The businesses operating here create jobs and generate income, contributing to GDP growth and local government revenues.

The cluster promotes industrialization and modernization, producing high-quality products to meet market demand while enhancing the skills of the local workforce.

| Indicator | 2020 | 2021 | 2022 |

| Revenue (billion VND) | 1,800 | 2,100 | 2,500 |

| Labor Force (people) | 4,500 | 5,200 | 5,800 |

| Contribution to GRDP (%) | 12% | 14% | 16% |

The Dam Hong I.C plays a crucial role in the economic development of Yen Bai Province by driving industrialization and enhancing local competitiveness.

Investment Support and Attraction Policies

The Yen Bai provincial government has implemented support policies to attract investment and promote the development of the Dam Hong I.C. These policies include:

- Legal and administrative support

- Tax incentives and land discounts

- Provision of technical infrastructure and transportation

- Training and development of skilled labor

| Policy | Content | Benefit |

| Tax Incentives | Corporate income tax and import tax exemptions | Reduced costs, increased profits |

| Land Incentives | Preferential land lease and sale prices | Lower investment costs, competitive advantage |

| Infrastructure Support | Development of roads, electricity, and water systems | Improved investment environment and productivity |

With these incentives, the Dam Hong I.C has attracted numerous investment projects, driving local socio-economic growth.

Challenges and Issues to Address

The Dam Hong Industrial Cluster faces challenges related to environmental sustainability and competitiveness.

Environmental Issues and Sustainable Development

Industrial production in the cluster can lead to water and air pollution. To address this, businesses need to implement waste management practices and raise awareness about environmental protection.

Enhancing Competitiveness

To attract more investment, the Dam Hong I.C must improve its competitiveness. This involves technological innovation and product quality improvement, with support from local authorities.

Future Development Directions

The Dam Hong I.C aims to become a major industrial hub by focusing on agricultural processing and building materials production.

- Attract more investment projects in agricultural processing and building materials production

- Prioritize environmentally friendly technologies

- Enhance the competitiveness of enterprises through innovation and upgrades

The cluster’s goal is to become a leading industrial center, driving sustainable socio-economic development in Yen Bai Province.

To achieve this, the cluster will implement investment support policies and enhance business management and sustainability.

Conclusion

The Dam Hong Industrial Cluster plays a vital role in socio-economic development in Yen Bai Province. With strategic location and modern infrastructure, it attracts many investors.

In the future, the cluster will continue to receive investments, aiming to become a key industrial center in Yen Bai. This will promote sustainable economic growth, create jobs, and increase incomes for residents.

With its potential and advantages, the Dam Hong I.C will shine as a key player in the future industrial development of Yen Bai Province.

Other industrial zones

- Au Lau Industrial Cluster In Yen Bai Province

- Au Lau Industrial Park In Yen Bai Province

- Bac Van Yen Industrial Cluster In Yen Bai Province

- Bao Dap Industrial Cluster In Yen Bai Province

- Dam Hong Industrial Cluster In Yen Bai Province

- Dong An Industrial Cluster In Yen Bai Province

- Hung Khanh Industrial Cluster In Yen Bai Province

- Minh Quan Industrial Park In Yen Bai Province

- Mong Son Industrial Park In Yen Bai Province

- Phia Nam Industrial Park In Yen Bai Province

- Phia Tay Cau Mau A Industrial Cluster In Yen Bai Province

- Son Thinh Industrial Cluster In Yen Bai Province

- Thinh Hung Industrial Cluster In Yen Bai Province

- Y Can Industrial Cluster In Yen Bai Province

FAQ

What is the geographic location of the Dam Hong Industrial Cluster?

It is located in Luc Yen District, Yen Bai Province, near the district center and major transportation routes.

What are the features of the transportation system at Dam Hong?

The cluster has a well-connected transportation network, including national highways, provincial roads, and internal roads, facilitating the transport of materials and goods.

What are the main industries in the Dam Hong Industrial Cluster?

The key industries are agricultural processing and building materials production.

What advantages does the cluster offer?

The cluster benefits from abundant raw materials and a skilled labor force, attracting investors.

What is the role of the cluster in local economic development?

The cluster creates jobs, increases incomes, and contributes to GDP growth and government revenue.

What challenges does the Dam Hong Industrial Cluster face?

The cluster must address environmental sustainability and enhance competitiveness to attract more investment.

What are the future development directions for the cluster?

The cluster will focus on agricultural processing and building materials production while enhancing enterprise competitiveness through innovation.